Example surgical practice

First, I want to show you a bad asset-protection practice structure for a surgical practice. In this diagram (click the diagram to enlarge), you'll see a single practice entity with the doctors as the owners. This entity owns the practice's equipment, real estate, accounts receivable, hires employees; in short, it attempts to accomplish everything all in a single entity.

Instead of separating out distinct categories, it lumps everything into a single entity. While this may be the most common scenario, it's not the best nor the most efficient.

Further, and most importantly, it exposes the entire practice to malpractice risk. Instead of separating out the professional services from the non-professional, it exposes all the non-professional parts to malpractice risk.

This single-entity structure is poor for several reasons:

-

What if a doctor wants to insulate malpractice from the non-professional aspects of the practice, as well as insulate herself from the malpractice of her partners and associates?

-

What if a doctor wants to quit practicing, but wants to still own the real estate?

-

What if you want to give certain retirement benefits to the doctors, but not to other employees?

-

What if you want to shield more property from malpractice exposure?

-

What if you want the spouses and children of the doctors to have some ownership interest, but can't own the practice by law?

-

What if the doctors wanted it to be easier to bring in new partners and associates, without having to have a massive practice valuation done each time?

-

What if the doctors had multiple locations, and wanted to simplify separation of ownership of the locations, while streamlining staff, equipment, and other issues?

A modular surgical practice is the answer

These issues and more can be taken care of and more with a modularized practice that takes into account good asset protection and business planning from the beginning:

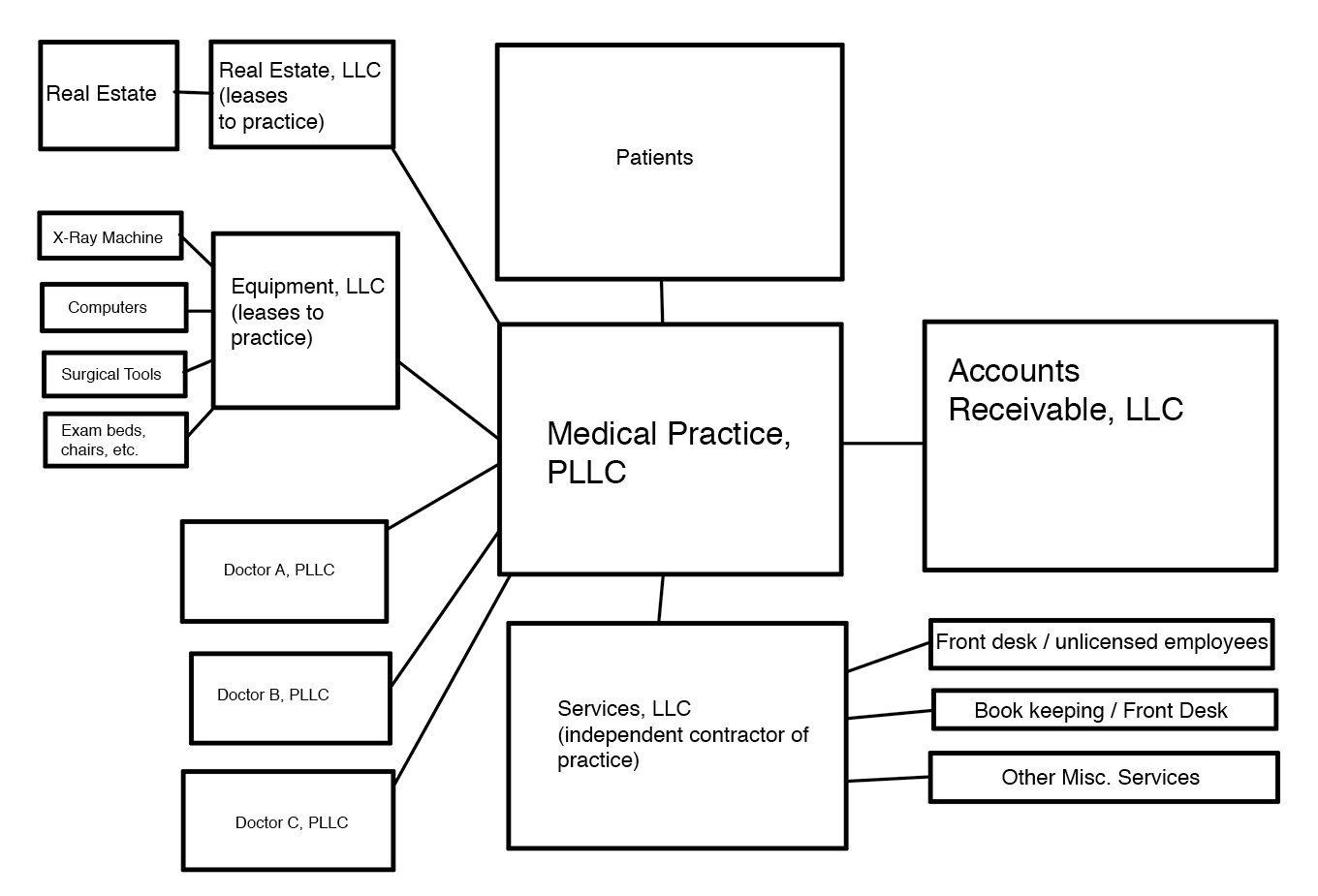

In this diagram, you'll see the non-business portions of the practice compartmentalized from the professional services. Each surgeon forms their own individual PLLC, PA, or PC, that is owned solely by the respective individual surgeon. This gives each surgeon flexibility on taxation choice, and compensation on a per entity level. The professional entities then either jointly own a PLLC, or jointly own a limited liability partnership to act as what we think of as the "practice".

The practice then rents its office space from the Real Estate LLC, that in turn owns the land. The practice also leases from an Equipment LLC all the high-capital equipment such as x-ray machines, an MRI, surgical instruments, computers, exam beds and chairs, and so forth. The practice then either borrows money or sells it's accounts receivables to an Accounts Receivables, LLC.

The practice subcontracts with a Services, LLC, to provide it non-licensed employees, front-desk staff, book keeping, and other day-to-day non-professional services. The key distinction is then that any non-licensed employees won't be employees of the practice! This means if one of the front-desk staff makes a mistake, it's likely that only the Services, LLC is going to be in trouble, not the practice! If that happens, the practice terminates its contract with Services, LLC and forms a new Services2, LLC and goes on with business as usual.

All of these entities allow (a) non-doctor owners (i.e. Doctors' spouses, kids, outside investors, etc.) to own a portion of the practice; (b) every single dollar shifted out of the practice for a legitimate purpose shields that dollar from malpractice exposure; and (c) there may be some income tax planning advantages and other tax efficiencies available.

Assuming the doctor is in the top income tax bracket, but his 30 year old child is not, shifting some of the income to the 30 year old child by making the child a part owner in one or more of the entities will actually save taxes while netting the Doctor similar income. This allows the wealth to stay in the family. However, this income tax efficiency usually only works for children when the "kiddie" tax is not in effect. There may be other tax efficiencies in the form of taxation chosen by each entity.

But what if I'm a solo surgeon?

You can still benefit from a modular practice; particularly by having trusted co-owners of the other entities. It can also be a good capital raising opportunity as well as a way to get your non-professional spouse and children involved in the family business. And it can help reduce the impact of a drastic malpractice lawsuit.

For example, assume that you commit malpractice, and you have a modular practice like the above. The Plaintiff sues you personally (no entity can shield you from your own negligence) and your practice entity. The Plaintiff wins a million dollar judgment against you and the practice above and beyond your insurance coverage. The Practice entity doesn't own anything as it leases all of its equipment, borrows against its accounts receivables (or has sold its accounts receivables), doesn't own any real estate, and doesn't even have employees. Likely its only asset is a checking account.

So the Plaintiff's lawyer likely only gets the few thousand dollars in the practice's bank account. Then the Plaintiff tries to collect the rest from you individually. But you were smart, and all of your "outside" entities were (for example) owned 25% you, 25% your spouse, and 50% by a trust (controlled by you or a trusted third party) in favor of your kids. The Plaintiff's lawyer gets really sad when he sees these structures because he can't foreclose your LLC interests, he likely can't foreclose your homestead, he can't foreclose many retirement plans, and all he can get is a charging order against your 25% interest of the LLCs.

And, if you formed each of these entities in a smart manner, you may be able to still continue to make distributions to the wife and children's trust but not distribute any money to the creditor. In fact, the creditor may have to pay taxes on "phantom income" even though it hasn't received a dime. This may entice the creditor to abandon the claim, or to offer a pennies-on-the-dollar settlement. The real estate is protected, the equipment is protected, and your family has much better protection from that nightmare malpractice experience.

Finally, because of laws against fraudulent/voidable transfers, the time to put these structures into place is before the liability arises. Once the liability arises it may be too late to do these sorts of transactions.