Common entity structures

This article will discuss several different business structures, including formal entities and non-entities, that real estate investors and other investors may use. This list is not exhaustive, but it does cover many of the most common scenarios available to small businesses.

But first, a quick note on vocabulary: Please pay close attention to the words "partner" and "partnership." They are very specific legal terms of art that cover centuries worth of law and legal theory. Further, there are numerous different kinds of partnerships out there; but, the main distinctions are between General Partnerships versus Limited Partnerships. Not all are created equal. For instance, this office rarely if never recommends a general partnership structure but this office will frequently recommend a limited partnership structure. Further, a General Partner means something distinct from a General Partnership; same with a Limited Partner versus a Limited Partnership.

Sole Proprietorship

This is the default business structure if you operate a business by yourself without forming any entity. Many people will use the slang: "sole prop" to refer to this structure. If you run a sole proprietorship, you are known as the "proprietor" of the business. Please note that it is not a formal entity. Its benefits include no extra tax return, no legal fees to form an entity. It's drawbacks include absolutely no liability protection whatsoever, your personal non-business assets are fully exposed, and may actually cost more in the long run if you are sued.

Conclusion: rarely if never recommended because there is no liability protection.

General Partnerships and Joint Ventures

A General Partnership is akin to a Sole Proprietor in that it arises by default without any action necessary to begin its existence other than going into business with a total of two or more people. There must be two or more persons to form a general partnership. A Joint Venture is a general partnership limited to a single real estate deal. Benefits include Subchapter-K taxation, flow-through taxation, large management flexibility, they can be inexpensive if you are ok rolling the dice with the default laws (you should NOT be ok rolling the dice), no filing fee to the state, not securities, The drawbacks are unlimited personal liability for your actions AND unlimited personal liability (that means you) for the actions of all of your partners (yes, you read that right, your partner can incur liability that YOU have to pay for), partners can't be paid as a W2 employee, files a tax return, and other drawbacks.

Many times you'll see an investment club structured as a general partnership in order to get around the many securities regulation issues inherent in other issues. Investment Company Act issues aside, you're much better off encapsulating such a structure inside of a member-managed LLC to get some liability protection.

Conclusion: rarely if never recommended because there is no liability protection.

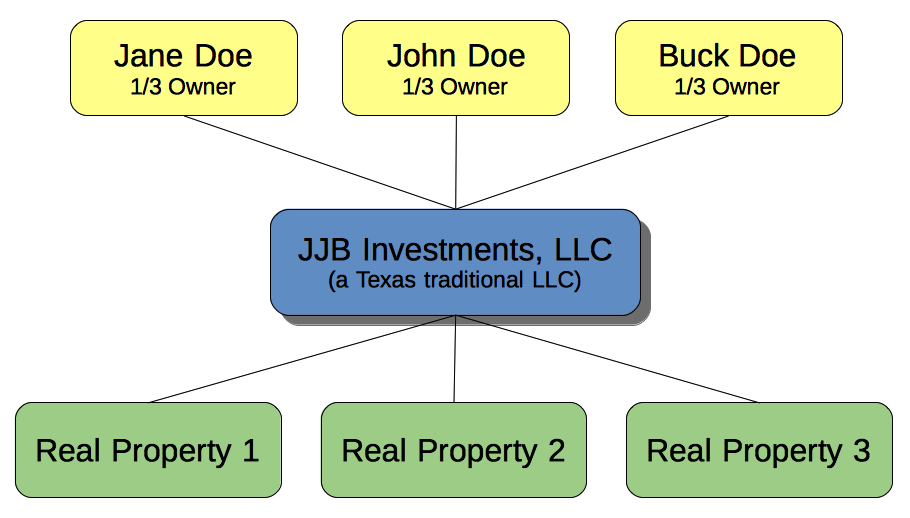

Single Traditional LLC

In this structure we see our first layer of real liability protection for the owners. You can have one or more "members", can choose how you want to be taxed (see our chapter on Taxes1), have great flexibility in management (can choose a management structure like a traditional general partnership, limited partnership, corporation, or a hybrid of any of the above), and have strong protections from creditors built into MI and TX law.

For a non-real estate business, sometimes this is all you need. However, for real estate (excluding management companies), if you want to own more than one property, and you own all of them in a single LLC, you are putting all of your eggs (your properties) into a single basket.

For example, let's assume you own three single-family residences (properties A, B, & C) under ABC Investments, LLC. Your tenant slips and falls because of a hidden condition at Property A. Plaintiff sues you and wins a very large judgment. Plaintiff's attorney can go after all three properties. If the properties were split up, however, they would likely not be subject to the slip and fall.

Conclusion: recommended sometimes for certain non-real estate businesses (management companies are an exception), and better than nothing for real estate, but prefer other structures for real estate business

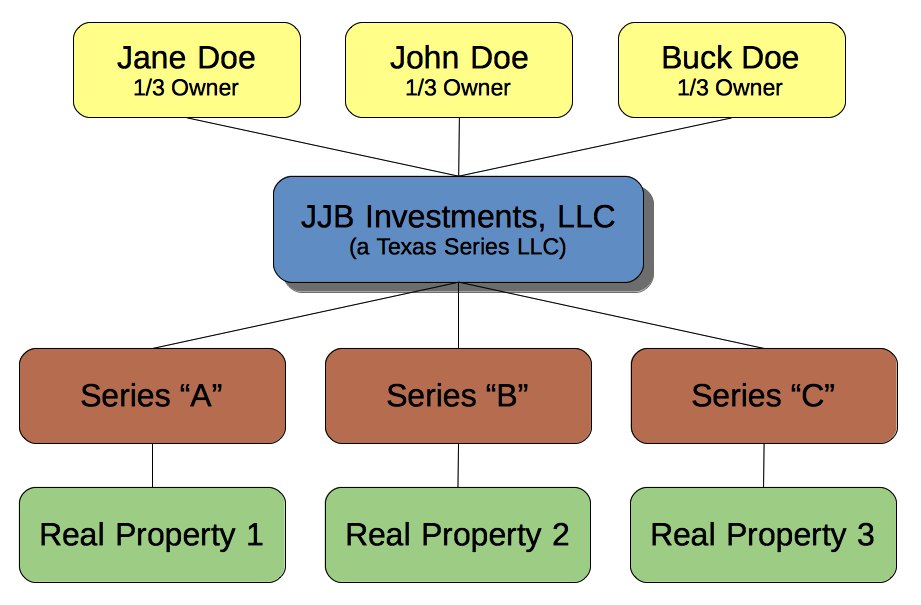

Single Series TX LLC

Note: This strategy is only available in Texas or other states that recognize series LLC protections. It is not appropriate for Michigan assets; however, the Hub-and-Spoke model discussed in this article is appropriate for Michigan assets.

A series LLC is a relatively new invention in the LLC realm. It lets a single LLC operate under individual chunks of the LLC called "Series". If the proper formalities are followed, the assets and liabilities of each series should remain compartmentalized from the other series of the LLC and from the LLC as a whole. The main advantage to a series LLC is the ability to keep multiple parcels separate from the others.

Take a look at the diagram. The three Doe's are the owners (in their personal capacity) as owners of JJB Investments, LLC. The LLC then has three series underneath it that separate Real Properties 1 through 3.

Benefits include better liability protection, only a single large filing fee to the state with much smaller filing fees per series, typically only one tax return, management flexibility, and all the other benefits of a traditional LLC. Drawbacks include increased bookkeeping, not well tested in the courts due to their novelty, may be better for additional LLC(s) to perform other tasks, more paperwork for each series, assumed name certificates for each series needed, and deeds of real property to the series need some customized language to indicate ownership by a specific series as opposed to the LLC as a whole.

Despite all of their drawbacks, their benefits are significant. Series LLCs are growing in importance and should be on the radar of any investor, not just real-estate investors.

Conclusion: recommended as our minimum-level real-estate investment structure but there are still better structures.

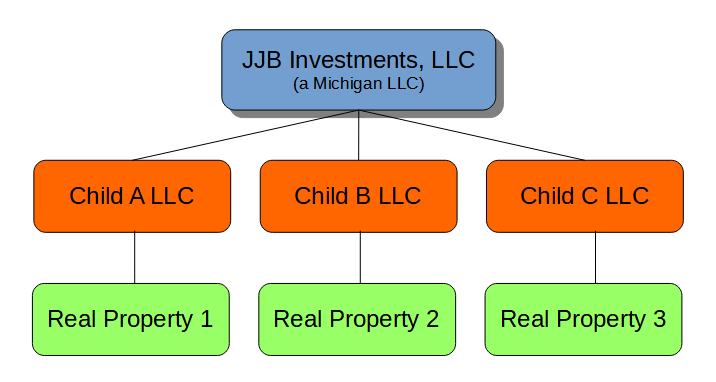

Hub and Spoke Model for states without Series LLC protections

In Texas, we would likely use a series LLC to achieve these goals as the filing fee is approximately $300 per LLC in Texas; however, this structure is appropriate for states like Michigan that do not have series LLC protections, and Michigan in particular only has a $50 per LLC filing fee

Here is how we achieve asset compartmentalization in a state without series LLC statutes, such as Michigan. In place of each series, we just form an additional LLC. Typically, the parent company (JJB Investments) would own each child company 100% and cause the child company to be considered a disregarded entity by the IRS. This means that for each such disregarded entity, there is no tax return needed and the income flows up to the parent company and is only reported on the parent company's taxes; as far as the IRS is concerned, disregarded entities don't exist for tax purposes. However, the asset protection of that LLC is unaffected2 and serves the same purposes as a series in the above section.

Conclusion: Prefer series LLCs in Texas but this is the basic asset compartmentalization strategy in Michigan.

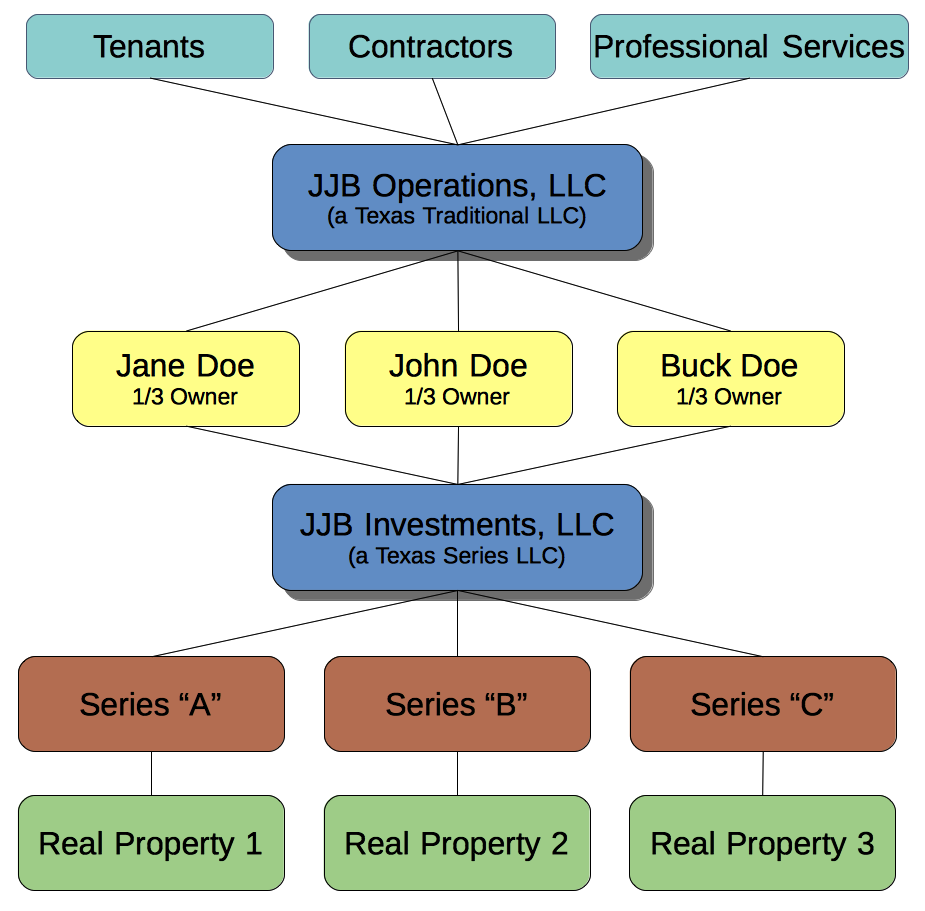

Two LLC Structure: Series Holding Company and Operations Company

Note: This strategy is only available in Texas or other states that recognize series LLC protections. It is not appropriate for Michigan assets. However, a similar structure to this can be obtained in Michigan by adding an additional LLC to the hub-and-spoke model described above.

Now we're at our recommended structure for many different businesses, particularly those businesses that are capital intensive. Take a look at the diagram (click to enlarge). You note that the three Doe owners each own the two companies; but, notice that the companies don't own each other. Here's the quick explanation of how they work:

The Holding Company is formed as a TX Series LLC. It holds title to various assets, such as real estate and equipment. But, it does not have any activities with any outside third parties. That's where the second LLC comes into the picture: it takes possession of, but not title to, the assets. The Operating company will then operate the assets and interact with third parties, tenants, contractors, and so on. In the diagram, JJB Operations would contract with each Series individually to take possession of, but not title to, the respective real property owned by each series.

The Operating company is not intended to ever own any substantial assets. We sometimes call these "shell" companies because there's not much inside. The Operating company is intended to be the target of any lawsuits (ideally, third parties won't even know the existence of the holding company) and if sued and loses (or if the cost to defend the suit is massive) you can fold the shell company and launch a new shell company.

The holding company is relatively sheltered because it never contracted with the Plaintiff. In other words, it never had privity of contract with the plaintiff. Further, using optional asset stripping techniques we can make the Operating Company (and even the Holding company) look asset poor and a less appealing lawsuit target very easily for equipment assets, and moderately easily for real estate assets.

In Michigan, instead of using a series LLC as the holding company, we would likely do a hub-and-spoke model as described above since Michigan does not recognize series LLC protections at the time of writing; however, Michigan's filing fee per LLC is 1/6 the cost of a Texas LLC, so the cost savings of a Texas series LLC do not matter as much.

Conclusion: this is our bread-and-butter arrangement for most business structures, real-estate included. However, there are more advanced structures available.

Multi-venture Holding Company

Note: This strategy is only available in Texas or other states that recognize series LLC protections. It is not appropriate for Michigan assets. However, a similar structure to this can be obtained in Michigan by adding an additional LLC to the hub-and-spoke model described above.

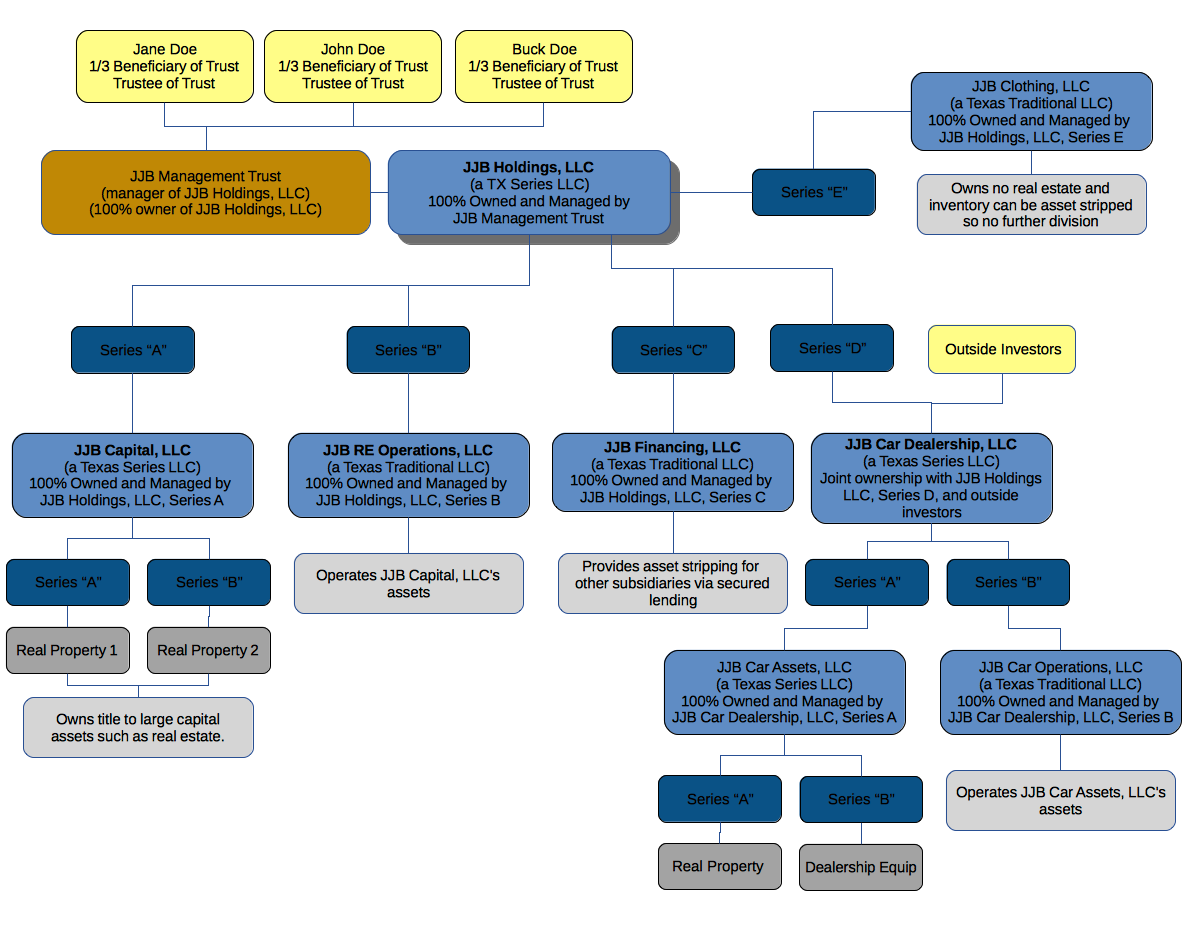

This structure is for the small business owner whose small business empire is spanning multiple types of businesses and wishes to simplify perhaps multiple disjointed operating structures. Let's take a look at the diagram.

Right off the bat, we see that we have a main Holdings series LLC, owned by the three Doe LLC members, and managed by a trust. The trust is a new wrinkle that throws in some anonymity in that in TX a manager managed LLC typically only discloses the names of its managers instead of members on the certificate of formation. This keeps the members' personal names out of the public records until the first public information report is due. If the trust is also the 100% member, then only the trust's name will be disclosed as the owner.

We see a real estate venture operating under Series "A" and "B" of the Holdings company with JJB Capital, LLC and JJB RE Operations, LLC. This is just our earlier two-company structure owned by a parent company instead of people. The Holdings company also has their hands in other business ventures.

The car dealership shows another two-company struture, but this time with outside investors, so there is a sub-holding company.

The beauty of this structure is that many of these companies are disregarded entities and are flowing through their earnings to the Holdings company, reducing the amount of tax returns necessary. We likely have a tax return at the Holdings company level, the JJB Car Dealership LLC level, and possibly at the trust level.

It may look horribly complex in graph form; but, it's actually simpler than running each of the respective businesses as separate LLCs.

In Michigan, for any place that is using a series LLC in the diagram, instead of using a series LLC, we would likely do a hub-and-spoke model as described above since Michigan does not recognize series LLC protections at the time of writing; however, Michigan's filing fee per LLC is 1/6 the cost of a Texas LLC, so the cost savings of a Texas series LLC do not matter as much.

Conclusion: For multi-venture investors, variations of this structure are highly recommended.

Trusts

Trusts are also a valid method to own real estate, however, trusts, particularly those that are revocable or otherwise self-settled, lack liability protection. So, they are typically used for anonymity purposes, and also to comply with regulations prohibiting certain seller financing, wraps, lease options, and so forth. My preferred use for trusts for real estate investing is to use them as managers and owners of LLC interests to give the owners a degree of anonymity. In other words, the trust owns the LLC, the LLC owns the land.

In Texas, you'll sometimes see some transactions proposed about contributing land to a trust, and then naming an LLC as the beneficiary of the trust, in order to avoid due-on-sale-clause issues. This comes about due to the notice requirements in Texas Property Code 5.016. My opinion is that all this does is avoid having to send a short notice letter to the lien holder in Texas about the transfer (although the original transfer to the trust does have to send that notice letter). If certain requirements are met, that initial transfer to the trust is not subject to due-on-sale clause issues; however, once you name the LLC as a beneficiary and rent out the property, those due-on-sale clause protections likely no longer apply. It's my opinion that this strategy is high cost and low-to-no reward, so I often do not recommend it. My philosophy is the trust owns the LLC, the LLC owns the land. The bank can easily find out ownership based on the deed records, the tax assessor's records, escrow records if escrowed, and the insurance records; in other words, there's no keeping true ownership hidden from the bank.

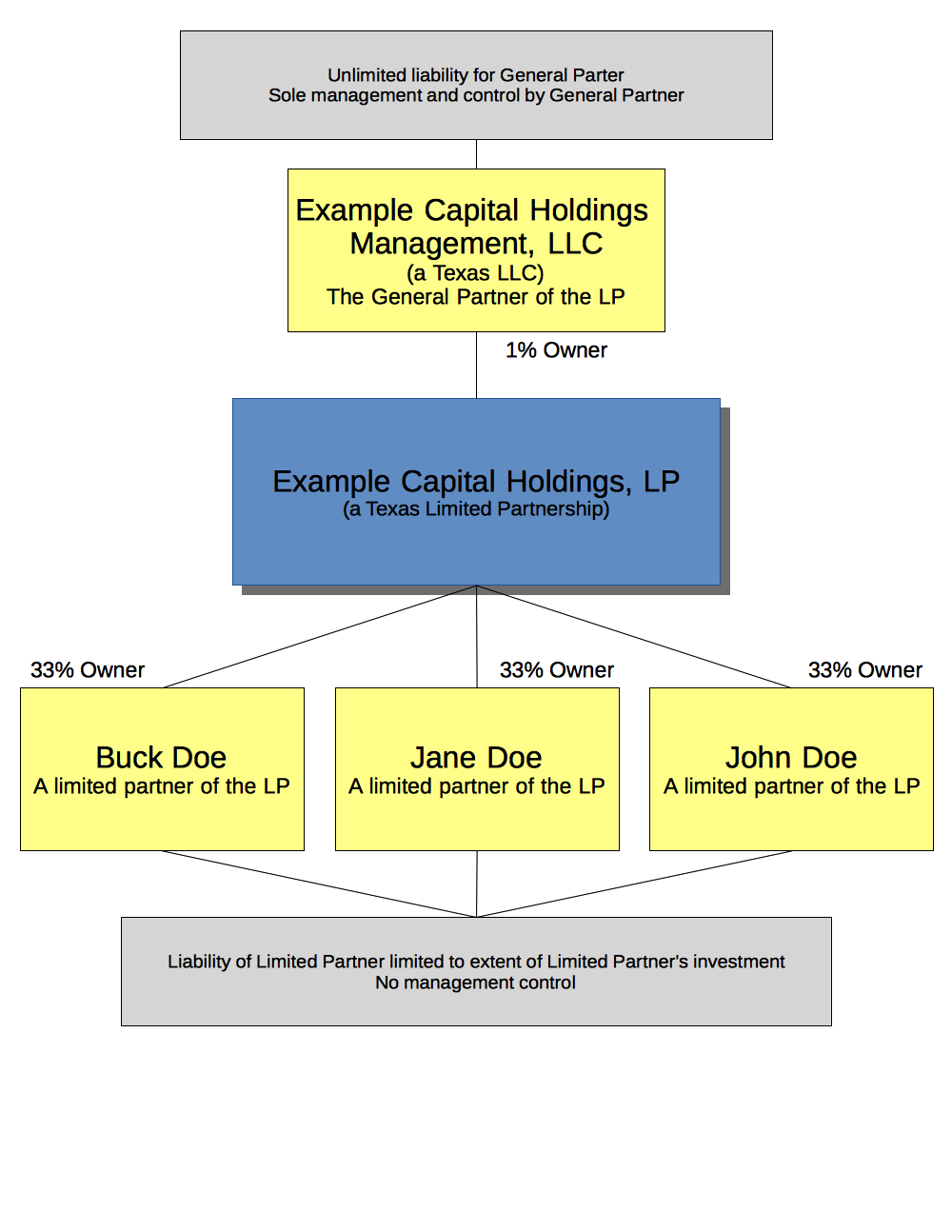

Limited Partnerships

While slowly being replaced by the LLC, sometimes there is no substitute for the venerable Limited Partnership. A Limited Partnership has at least two partners, one who is a General Partner, and one who is a Limited Partner. You can have more than one of each, so long as there is at least one of each type of partner.

-

General Partners of a Limited Partnership have management control and have unlimited personal liability for the actions of the Partnership.

-

Limited Partners have no management control (usually limited to voting in or out the general partner and other fundamental business transactions such as closing down the partnership). In exchange for giving up their management, Limited Partners' risk in the partnership is limited solely to the value of their Limited Partnership interest.

This arrangement works well for partnership between "money investors" (the limited partners) and the "idea and workers" the (general partners). The idea partner likes that he retains management control and gets capital from money investors, and the money investors like that they don't have to manage the partnership nor incur liability beyond their investment.

The advantages of a Limited Partnership over an LLC can be significant; there is no question of the limited partners liability protection, whereas in LLCs the protection exists but is not as concrete nor as tested in the courts. Limited Partnerships in Texas sometimes have tax advantages when dealing with passive income and oil and gas revenues. Limited Partnerships may be more tax efficient from a self employment tax standpoint in that limited partners don't pay SECA tax on their income. It's still up in the air whether LLCs taxed as partnership can continue to claim the same limited partner treatment for non-active LLC members. The management structure of a Limited Partnership is well known throughout the country, whereas LLC protections will be more on a state-by-state basis. Not all LLC states are created alike.

So why aren't these entities used more than LLCs? Because they're expensive.

Remember how the general partner has unlimited personal liability? Because of this, the general partner is frequently formed as an additional LLC or corporation to protect the natural person owners behind the limited partnership's management. In TX, there is also a hefty filing fee ($750) to the state for the Limited Partnership that is more than double the filing fee for an LLC. Compare this to Michigan, which has a $10 filing fee to the state.

Finally, a limited partners interest will almost always be considered a "security" that is subject to state and federal regulations that must be dealt with. These regulations can be considerably burdensome, depending on the transaction. An applicable exemption needs to be found at both the states of all residences of owners and at the federal level. While LLC interests may also be considered securities, there is more wiggle room in the security definition as opposed to limited partner interests.

So where do Limited Partnerships fit into the above structures? They can serve as the parent holding company in the multi-venture structure. If they serve as the holding company in the two-company structure, they might need a third entity to be the series LLC to compartmentalize assets from operations. Typically, though, limited partnerships see most use when raising capital from outside investors. They are frequently used in development, construction, and syndication; frequently they raise capital to purchase a shopping mall, skyscraper, or other significant (multi-million) capital asset. Hedge funds, venture capital funds, private equity funds, and the like are frequently formed as limited partnerships, although LLCs do have their place.

Further, Limited Partnerships have a reduced disclosure requirement for private offerings under Regulation D (17 CFR § 230.501 et seq.). Depending on the size of the offering, a Limited Partnership may be able to avoid providing audited financial statements for anything other than the issuer's balance sheet. Because of this, Limited Partnerships are often used for private offerings under Regulation D Rules 505 and 506(b) offerings.

My prediction is that we'll see a resurgence of Limited Partnerships if the IRS ever finalizes regulations that deal with whether or not passive LLC members' interests are subject to SECA, and the IRS says the interests ARE subject to SECA. Until then, the LLC will likely be the preferred structure of Texan small business owners.

Conclusion: expensive (in TX) but sometimes necessary. Wonderful for raising outside capital.

TODO: Need a link to the Taxes chapter

In some states, single-member LLCs are not afforded the same amount of asset protection. Texas and Michigan, however, give comparable asset protection to single-member LLCs as they do multi-member LLCs.